Abstract

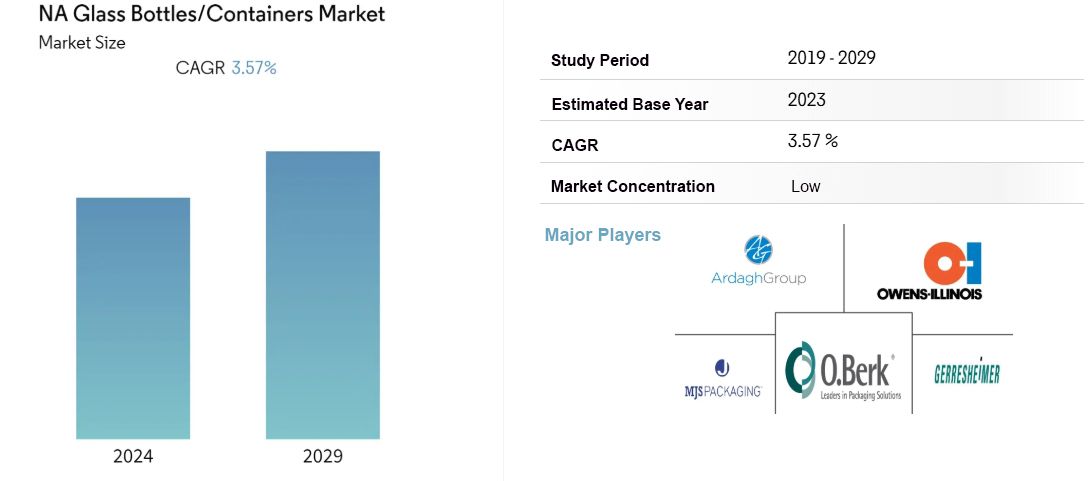

The North American glass packaging market is on a structural growth path, with the market size projected to be $30.6 billion in 2024 and to reach $36.2 billion in 2029, at a compound annual growth rate (CAGR) of 3.57%. This article analyzes the core drivers and competitive landscape of the market through authoritative data sources, and reveals the growth opportunities in the three major areas of beverages, pharmaceuticals, and cosmetics.

I. Market Size and Growth Forecast

1. North America Market Core Data

- Size by 2024: $30.6 billion (25% of global glass packaging market)

- 2029 forecast: $36.2 billion (CAGR 3.57%)

- Segment share: 58% of the beverage industry (2024), expected to rise to 62% by 2029.

2. Global Comparison and Regional Characterization

| Region | 2024 Size (Billion USD) | 2029 Forecast (Billion USD) | CAGR |

|---|---|---|---|

| North America | 306 | 362 | 3.57% |

| Asia | 1,225 (Glass Containers) | 1,800 (2027)3 | 6% |

| Europe | 210 | 250 | 3.5% |

II. Core Growth Drivers

1. Policy & Environmental Trends

- Accelerating Plastic Replacement: California’s AB 2784 requires more than 75% recyclable packaging by 2025, driving glass penetration in the beverage industry from 58% in 2024 to 62% in 2029.

- Circular Economy Model: Glass recycling rate in the US has reached 33%, targeting to rise to 60% by 2030, and cost of refillable glass bottles reduced by 30% (e.g. Kraft Heinz case).

2. Technological Innovation and Cost Optimization

- Lightweight technology: Corning’s “Valor Glass” pill bottles reduce weight by 20%, increase productivity by 50%, and the North American ultra-light glass market will reach $2.8 billion by 2024, with a CAGR of 8%.

- Digital Printing: Gerresheimer AG’s 3D embossing customization technology shortens the order delivery cycle to 72 hours, with a premium of 30%.

3. Consumption Upgrade and Channel Change

- High-end demand: Estee Lauder’s glass packaging products have 18% higher profit margins than plastic, with premiums of up to 200% for limited edition perfume bottles.

- Outbreak of e-commerce channels: Drizly, a wine platform, has seen 500% growth in new customers, and with a breakage rate of less than 0.5%, glass bottles have become the preferred choice for online sales.

Translated with DeepL.com (free version)

III. Industry challenges and competitive landscape

1. Cost pressures and competition from substitutes

- Raw material volatility: annual increase of 4-6% in the price of soda ash, companies hedge their costs by reducing energy consumption by 15% through electric melting furnace technology.

- Aluminum can impact: beer market share of aluminum cans rises from 18% in 2019 to 25% in 2024, but glass still accounts for 95% share in high-end alcohol (e.g. wine).

2. Concentration of headline players

| Firms | Market Share (2024) | Competitive Advantage |

|---|---|---|

| Owens-Illinois Inc. | 22% | Valor leads in glass technology, pharmaceutical bottle capacity |

| Ardagh Group | 18% | Supply Chain Integration for Returnable Bottles |

| Gerresheimer AG | 15% | Customized & Digital Printing |

| SMEs (e.g. MJS) | 10% | Pharmaceutical segment specialization (15% growth rate) |

Source: Industry reports, company financial reports.

IV. Future Outlook

The North American glass packaging market will continue to grow under the triple driving force of environmental policy, technological innovation, and consumer upgrading, and is expected to break through the market size of 40 billion U.S. dollars in 2030. Enterprises need to focus on:

- Lightweight and circular design: invest in nano-coating technology to extend bottle life.

- Digitalized Supply Chain: tracking the efficiency of recycled bottle flow through IoT.

- High-end market segments: expand functional glass (e.g., antimicrobial, smart temperature control) in pharmaceutical applications.